Analytical & Creative Thinking Skills (Online)

Effective managers and workers are characterized to possess problem solving skills that are analytical and creative, even though different skills are required for each type of problem. This course will stimulate, challenge and unleash your abilities to analyse and conceptualize creative solutions for greater effectiveness and efficiency. It will then offer participants specific guidelines and techniques for improving both analytical and creative thinking skills. It will conclude with a discussion of how participants can foster creative thinking and innovation among the people with whom they work.

1. Increase personal efficiency in analytical and creative thinking skills

2. Recognise personal conceptual blocks and enhance creativity by overcoming them

3. Foster innovativeness within you and among others in a group

1. What is creativity?

2. Why do we need creativity at work?

3. Impact of creativity on you professionally

4. Identify your creative challenges

5. Mental barriers to creative thinking and problem solving

6. Let go of the past and take “risks”

7. Negative attitudes that block creativity

8. Positive attitudes for creativity

9. Characteristics of the creative person

10. Develop creative thinking tools for personal and work success

11. Personal action plan

DURATION

1 day (9.00am ~ 5.00pm)

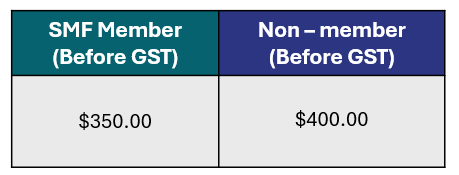

*Course fees before GST

Note that purchases of goods and services from GST-registered businesses will be subject to GST at 9% GST. The GST amount calculated will be based on full course fees.

• O Level and above

• A minimum of 3 years working experience

• Language proficiency is English, at GCE N’ Level

An applicant must be at least 18 years of age on admission to the programme.

1. All notice of withdrawal must be given in writing before the issuance of letter of confirmation. Once confirmation letter is sent to participant, no cancellation will be allowed or penalty charges will apply.

If notice of withdrawal is received:

– At least 1 week before commencement of the course, a 20% of the full course fee will be charged. For government-funded course, a 20% of full course fee before funding will be charged.

– Less than 1 week before commencement of the course, a 30% of the full course fee will be charged. For government-funded course, a 30% of full course fee before funding will be charged.

– No show on the scheduled date, a full course fee will be levied. For government-funded course, a full course fee before funding will be charged.

2. For all government-funded programmes (WSQ & Non-WSQ), funding is only applicable to:

– Singapore Citizens or Singapore Permanent Residents

– Participants who have achieved at least 75% attendance and passed all required assessments

Full course fee will be charged to participants who fail to meet the above-mentioned criteria.

3. When a course is cancelled, fail to commence or fail to complete under unforeseen circumstances, participant is allowed to defer the intake at no cost or withdraw from the course; under such situation, a full refund of the advance payment will be given.

4. Notice of change in participant’s name must be given in writing, not less than 5 days before the course commencement date.

5. SMF CCL reserves the right, at our sole discretion, to change, modify or otherwise alter these terms and conditions at any time. Such modifications shall become effective immediately upon the posting thereof.

6. SMF Centre for Corporate Learning Pte Ltd has a Data Protection Policy which provides more information about how we collect, use and disclose your personal data. Please click the link below to know more.

https://smfccl.sg/privacy/

1. The candidate has the right to disagree with the assessment decision made by the assessor.

2. When giving feedback to the candidate, the assessor must check with the candidate if he agrees with the assessment outcome.

3. If the candidate agrees with the assessment outcome, the assessor & the candidate must sign the Assessment Summary Record.

4. If the candidate disagrees with the assessment outcome, he/she should not sign in the Assessment Summary Record.

5. If the candidate intends to appeal the decision, he/she should first discuss the matter with the assessor/assessment manager.

6. If the candidate is still not satisfied with the decision, the candidate must notify the assessor of the decision to appeal. The assessor will reflect the candidate’s intention in the Feedback Section of the Assessment Summary Record.

7. The assessor will notify the assessor manager about the candidate’s intention to lodge an appeal.

8. The candidate must lodge the appeal within 7 days, giving reasons for appeal together with the appeal fee of $109.00 (inclusive of 9% GST).

9. The assessor can help the candidate with writing and lodging the appeal.

10. The assessment manager will collect information from the candidate & assessor and give a final decision.

11. A record of the appeal and any subsequent actions and findings will be made.

12. An Assessment Appeal Panel will be formed to review and give a decision.

13. The outcome of the appeal will be made known to the candidate within 2 weeks from the date the appeal was lodged.

14. The decision of the Assessment Appeal Panel is final and no further appeal will be entertained.

15. Please click the link below to fill up the Candidates Appeal Form.