Robotic Process Automation (RPA) for Manufacturing

This course aims to equip participants with the skills to easily create useful RPA scripts to automate their own desktop processes, without coding or programming knowledge. They will learn how to achieve this through using RPA software such as UiPath. It is suitable for participants who wish to explore improving their productivity through the adoption of RPA to automate their mundane, repetitive and error prone desktop processes.

Robotic Process Automation is the application of technology that allows employees in a company to configure software or a “robot” to capture and interpret existing applications for processing a transaction, manipulating data, triggering responses and communicating with other digital system. This course will show how businesses can automate some of the internal process to bring about an improvement in productivity and get employees to move up the work value chain.

It satisfies the manufacturing sector needs of skilled workforce to integrate data or functions from one application program with that of another application program – involves development of an integration plan, programming and the identification and utilization of appropriate middleware to optimize the connectivity and performance of disparate applications across target environments.

At the end of the programme, learners will be able to:

- Appraise feasibility of Robotic Process Automation (RPA) through scanning and assessment for potential application integration.

- Create RPA to integrate data & functions and check connections across application program.

- Operate RPA to verify their functionalities across multiple or integrated platforms.

- Optimize on technical, compatibility or performance issues in application integration.

1. Opportunities for Using RPA

a. Introduction to RPA

i. What Is RPA?

ii. RPA Tools / Software Vendors

iii. What are the business benefits of RPA?

iv. How does RPA Work?

v. Where can RPA be used?

b. Workflow of RPA

c. RPA for Manufacturing

i. Advantages of Using RPA in Manufacturing

ii. Use Cases of RPA in Manufacturing

2. Create RPA to integrate data and functions

a. Introduction to UiPath

b. Getting Started with UiPath

c. Build First Automation with StudioX

i. Getting to Know StudioX – Microsoft Office

ii. First Automation Using Microsoft Office

1. Downloading the email attachments

2. Processing the invoices – retrieving the customer discount

3. Final checks and sending the files

4. Publishing the project

d. Citizen Developer Journey

3. Utilize RPA and verify their functionalities

a. File and Folder Automation in StudioX

i. Introduction to File and Folder Automation

ii. Practice – Adding a versioning number

b. User Interface Automation in StudioX

i. Recording UI Interactions

ii. Using the Object Repository

iii. The UI Automation Activities

iv. Extracting Data from an Application

v. Practice – The RPA Challenge

c. Decisions, Iterations, and Scenarios in StudioX

i. Decisions in automation

ii. Practice – Organize your local drive (1)

iii. Iterations in automation

iv. Practice – Organize your local drive (2)

v. Scenarios in automation

vi. Practice – Organize your local drive (3)

4. Improve technical, compatibility or performance issues

a. How to Handle Errors in StudioX

i. Validate and Analyze Your Project

ii. How to Troubleshoot Your Project

iii. Automation Best Practices

iv. Practice – Training Admin Assistant

b. Email Automation in StudioX

i. Email Automation

ii. Practice – SLA Assistant

c. Microsoft Excel Automation in StudioX

i. Cell Activities

ii. Range Activities

iii. Pivot Activities

iv. Chart Activities

v. Workbook Activities

vi. Practice – Books Sales Report

1. Part 1 – Generating the Weekly Sales Overviews

2. Part 2 – Updating the Sales Overview sheet

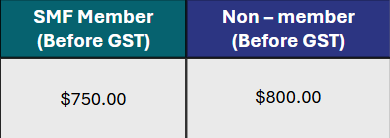

*Course fees before GST

Note that purchases of goods and services from GST-registered businesses will be subject to GST at 9% GST. The GST amount calculated will be based on full course fees.

It is recommended that participant meet the following:

- Minimum age requirement: 21 years old.

- Able to speak, listen, write, and read English with Numeracy skills at a minimum proficiency level 4 of the Employability Skills System (i.e., Workplace Literacy and Numeracy, WPLN).

- Possess Secondary School educational level qualification (O or N-Level).

- Some basic understanding / knowledge of automation.

- At least 2 years relevant supervisory or managerial work experience.

1. All notice of transfer/withdrawal / deferment must be given in writing and submitted at least 2 weeks prior to course commencement.

2. An administrative fee of $60 (GST inclusive) will be imposed if notice is received less than 2 weeks.

3. If notice of withdrawal is received:

- At least 1 week before commencement of the course, a 20% of the full course fee will be charged. For government-funded course, a 20% of full course fee before funding will be charged.

- Less than 1 week before commencement of the course, a 30% of the full course fee will be charged. For government- funded course, a 30% of full course fee before funding will be charged.

- No show on the scheduled date, a full course fee will be levied. For government-funded course, a full course fee before funding will be charged.

3. For all government-funded programmes (WSQ & Non-WSQ), funding is only applicable to:

- Singapore Citizens or Singapore Permanent Residents.

- Participants who have achieved at least 75% attendance and passed all required assessments.

- Full course fee will be charged to participants who fail to meet the above-mentioned criteria.

4. Certificates or Statement of Attainment or Certificate of Attendance will only be issued to participants who have achieved 75% attendance and undergo assessment (if applicable).

5. When a course is cancelled, fails to commence or fails to complete under unforeseen circumstances, participant is allowed to defer the intake at no cost or withdraw from the course; under such situation, a full refund of the advance payment will be given.

6. Notice of change in participant’s name must be given in writing, no less than 5 days prior to course commencement.

7. SMF reserves the right to change the venue, cancel or postpone the event without prior notice and full refund will be given under such circumstances. Such modifications shall become effective immediately upon the posting thereof. Please approach your account manager for more queries.

8. SMF Centre for Corporate Learning Pte Ltd has a Data Protection Policy which provides more information about how we collect, use and disclose your personal data. Please click the link below to know more.

https://smfccl.sg/privacy/

1. The candidate has the right to disagree with the assessment decision made by the assessor.

2. When giving feedback to the candidate, the assessor must check with the candidate if he agrees with the assessment outcome.

3. If the candidate agrees with the assessment outcome, the assessor & the candidate must sign the Assessment Summary Record.

4. If the candidate disagrees with the assessment outcome, he/she should not sign in the Assessment Summary Record.

5. If the candidate intends to appeal the decision, he/she should first discuss the matter with the assessor/assessment manager.

6. If the candidate is still not satisfied with the decision, the candidate must notify the assessor of the decision to appeal. The assessor will reflect the candidate’s intention in the Feedback Section of the Assessment Summary Record.

7. The assessor will notify the assessor manager about the candidate’s intention to lodge an appeal.

8. The candidate must lodge the appeal within 7 days, giving reasons for appeal together with the appeal fee of $109.00 (inclusive of 9% GST).

9. The assessor can help the candidate with writing and lodging the appeal.

10. The assessment manager will collect information from the candidate & assessor and give a final decision.

11. A record of the appeal and any subsequent actions and findings will be made.

12. An Assessment Appeal Panel will be formed to review and give a decision.

13. The outcome of the appeal will be made known to the candidate within 2 weeks from the date the appeal was lodged.

14. The decision of the Assessment Appeal Panel is final and no further appeal will be entertained.

15. Please click the link below to fill up the Candidates Appeal Form.